Institutional, Independent, Real Assets Investment Manager and Advisor with a current focus in Portuguese Real Estate.

The company was founded in 2018 by Partners with long-established careers in the Real Assets investment business.

We add value to our clients by bringing together capital and investment opportunities and delivering above-market risk-adjusted returns by focusing on active management, both at the operational and financial levels.

We advise and manage institutional capital via a multitude of structures, from Investment Funds to Managed Accounts and Special Purpose Vehicles.

We align interests between ourselves and with our clients by the highest standards. Our partnership structure plays a key role at attracting and retaining first class talent. Our people are our best asset.

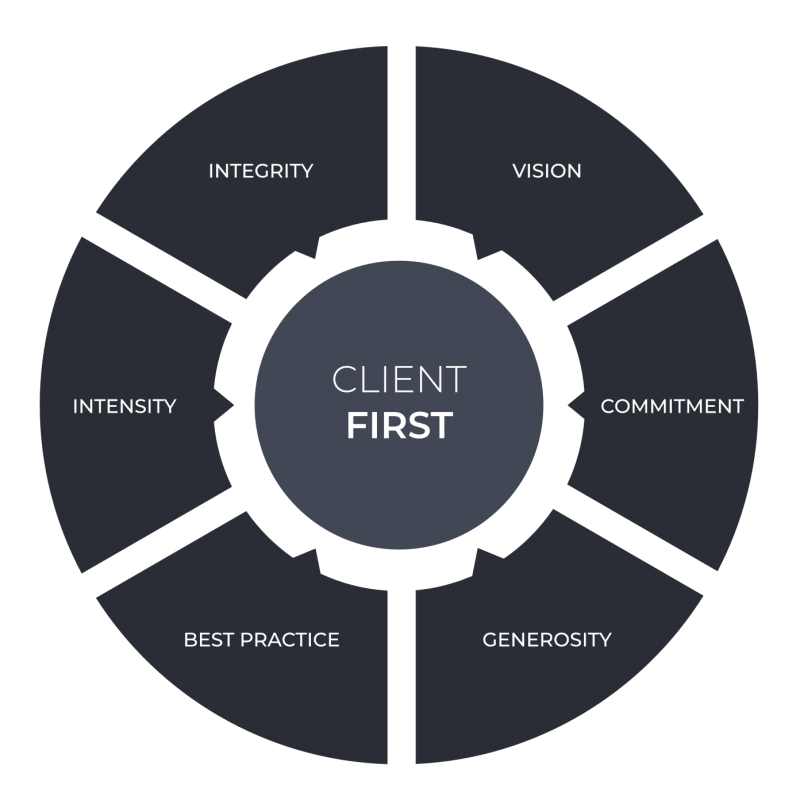

We are a client orientated organization

Strong relationships and alignment of interests between Clients, Team and Partners are at the center of our foundation.

Our clients include Pension Funds, Insurance Companies, Private Equity and Hedge Funds looking for:

- Market access and in-depth knowledge

- Execution capacity and know-how

- Track record

- Independence and alignment of interests

- International best-practice

Disciplined and quantified approach across all investment management workstreams.

We identify and extract value from Real Asset investment strategies by bringing together market access, experience and know-how at all levels of the investment life cycle, coupled with first class execution:

Local expertise

In depth knowledge of the geographies and sectors in which we operate;

Understanding of capital markets

Top down approach to sector pick and choice of investment strategies. Important timing consciousness for entering/exiting markets;

Sourcing investment opportunities

We maintain strong professional relationships and are a reliable counterparty renowned by our peers, consultants and industry specialists;

Transaction management

Team with solid track record of executing complex, time-pressured transactions;

Valuation/modelling

Bottom-up detailed asset pricing modelling, business planning and execution;

Operational execution

Strong track record managing complex asset replacement strategies involving engineering, planning, licensing and construction. Extensive construction and refurbishment experience in the office, residential and logistics sectors;

Capital structuring and management

Experienced and creative approach in sourcing and negotiating facilities across the capital structure in order to maximize equity returns in the context of a balanced equity risk profile;

Reporting

We believe in thorough and meaningful reporting as a base for taking educated management decisions, together with our investors and counterparties.

LACE was founded in 2018 by Partners with an average experience close to 20 years managing investments in the alternative Real Assets space on behalf of institutional clients.

We manage approximately €600 million of investment assets.

Lace Investment Partners manage approximately €600 million of investment/assets on behalf of institutional investors via several Funds and Managed Accounts.

The Partners and the Team have a significant track record managing Real Asset investments for tier 1 institutional clients, including operational intensive greenfield and repositioning strategies.

Our track record

- Since 2020, developing more than 500 hotel rooms in Lisbon in a portfolio of several assets’ construction and refurbishment

- In 2021, sale of Prime office building in a record-breaking value to the Portuguese office market

- In 2019-20, sale of c. €180 million of assets, including an office portfolio for more than €80 million

- In 2018 acquired the largest ever executed portfolio of more than 8,000 Real Estate Assets/Units in Portugal with a value of more than €350 million

- In 2017-2018 successfully repositioned, including a full refurbishment, more than 11,000 sqm of offices in Lisbon

- Since 2015, including the period prior to founding LACE, closed 11 transactions in the Portuguese Real Estate market worth c. €1.3 billion

- Successfully closed transactions worth €5 billion in the Iberian Real Assets space

- Managed the construction and repositioning of more than 450,000 sqm of real estate assets in Portugal and Spain across the Hotel, Office, Logistics and Residential sectors